What Can Affect Your Credit Score?

Unsure how credit bureaus assign your credit score? You’re not alone. A CNBC report shows that 4 out of 10 Americans aren’t familiar with how credit scores work. This lack of education leads to a chain of poor financial decisions. In fact, recent consumer credit surveys reveal that 16% of adult Americans have bad credit scores—scores ranging from 580 to 669.

Contrary to popular belief, it’s not difficult to grasp the concept of credit scores. These numbers indicate an individual’s trustworthiness when it comes to debt, loans, and other types of credit. The higher your score is, the better your chances are of working with various commercial banking institutions.

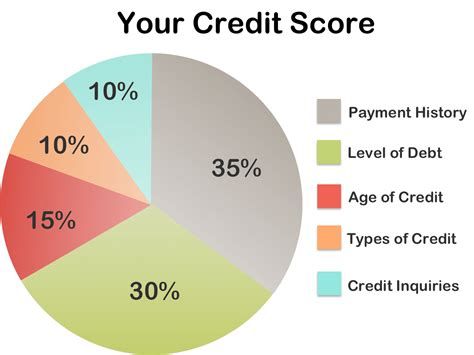

The best way to break down how credit scores work is to understand what factors credit bureaus take into consideration when assessing debtors. These include the following:

1. Loan Payment History (35%)

The most crucial factor that any credit bureau considers when assigning credit scores is the debtor’s loan payment history. Simply put, someone who has shown to regularly make on-time payments on all their active credit accounts is trustworthy, while someone who always misses their due dates is a delinquent.

Since an individual’s loan payment history is the biggest factor taken into consideration when being assigned a credit score, it’s only natural for bureaus to go beyond missed dues. Expect them to inspect everything pertaining to your payment history. In most cases, bureaus would go through the following:

Declared Bankruptcy Cases

One of the first things any credit bureau, banking institution, or lender would check is if the debtor has any history of bankruptcy. Bankruptcy stays on a debtor’s credit report for at least seven years. That’s why many people find it hard to recover and restart their credit standing after filing for bankruptcy—regardless of what chapter it is.

The best approach here is to avoid bankruptcy to the best of your abilities. Explore debt settlement options and negotiate with lenders who are willing to reduce your loan account’s interest rates or even cut your total debt amount. Only turn to bankruptcy once you’ve exhausted your alternatives.

Foreclosed Properties

What many debtors don’t know is that having the bank foreclose a property you’re still making payments on is just as bad as declaring bankruptcy. Reports indicate that foreclosures stay on one’s report for no less than seven years as well.

Pro Tip: Don’t let your properties get foreclosed. If you’re having financial problems and you’re sure you won’t be able to pay the mortgage anymore, find a buyer who’ll be willing to pay off the entire loan amount. Don’t expect to make a profit on this deal.

Outstanding Lawsuits

Debtors who have outstanding lawsuits are far from being good debtors. After all, a debtor can’t make payments on their loan accounts if they’re facing heavy charges, or worse, incarcerated for multiple years.

Wage Garnishments

Wage garnishments are issued on debtors who were brought to court. The idea here is the debtor’s employer holds a specific portion of their debtor’s monthly salary and directs this amount toward loan repayment. Creditors won’t lend to someone who has already been sued for missed payments.

Missed Payment Frequency

Unforeseen expenses are inevitable, so it’s completely normal for any debtor to miss one or two payments on their active credit accounts. That’s why bureaus also take frequency into consideration. A debtor will only be considered a delinquent if they miss consecutive payments on various accounts.

Unfortunately, frequently missed payments set credit scores back by a lot. In fact, bureaus consider debtors who missed 10 small payment dues half a decade ago less trustworthy than someone who missed a large payment last month.

2. Total Debt Amount (30%)

If your credit reports show that you’ve never missed a single payment from the day you got your first credit card, banks should be happy to lend you any amount, right? Not necessarily.

Each debtor has a set credit limit. This amount varies largely based on what type of loan accounts you have, how much your income is, and when you first started taking out loans. Going above the credit limit will negatively affect your credit standing.

Here are some of the factors credit bureaus go through when comparing a debtor’s total debt amount versus their available credit limit:

Credit Utilization Ratio

The credit utilization ratio (CUR) indicates how much revolving credit a debtor has. Generally, debtors with a high CUR are those who are nearing (or have reached) the limits on their credit accounts. Keep the ratio down to improve your credit standing.

The CUR is simpler to calculate than most make it out to be. All you need to do is divide your total debt amount versus your available credit limits. For example, let’s say you have five credit cards, namely:

A: $1,000 limit, $500 debt

B: $2,000 limit, $700 debt

C: $3,000 limit, $1000 debt

D: $4,000 limit, $2000 debt

E: $5,000 limit, $3000 debt

The total revolving debt is $7,200, while the total available credit limit is $15,000. If you divide $7,200 by $15,000, you’ll get a CUR of 48%. Is this a good result? No.

Experts say you should never go above a 30% CUR if you don’t want creditors to consider you a delinquent debtor. To really improve your standing, try to stay within 5% to 10% of your limit. A high CUR indicates the lack of financial resources to support one’s expenses, while a low CUR (below 5%) implies one isn’t actually using his/her account. Both cases are bad.

Total Loan Amount

Your credit utilization ratio only covers your revolving lines of credit and doesn’t factor in other types of secured/unsecured loans. Remember: mortgages, auto loans, and business loans are just as crucial to your credit standing.

In most cases, the credit bureau will total the debtor’s loan amount and compare it to their declared income. Generally, you’d only want to consume a small fraction of your income. If creditors see that you live paycheck to paycheck—even if you make six digits—they’ll assume you don’t have the sufficient funds to support your current lifestyle.

3. Credit Account Tenure (15%)

The credit bureaus classify newbie debtors who have only been using credit cards and loan products for a short time as risky. Generally, tenure equates to trustworthiness—as long as your credit accounts aren’t riddled with missed payments.

The best approach to improving this portion of your credit score is to keep your credit cards active by making payments on time. Do what you can to keep the account open. Canceled credit cards due to unpaid debt can look pretty nasty on any credit report.

Also, try taking out business and personal loans whenever you can. Banks will be more likely to work with established lenders rather than first-time applicants. Just make sure that the loans you take out will be used for a profit-generating business and that the total amount won’t hurt your credit utilization ratio.

4. Types of Active Credit Accounts (10%)

Your active loan and credit accounts have a 10% impact on your overall credit score. Banks would assume that tenured and established debtors have a mix of various credit accounts.

Although, note that this portion can get tricky. A diverse portfolio of different credit and loan accounts will only improve your standing if you do not miss payments, your credit utilization ratio is still low, your total monthly dues only consume a small portion of your income, and you’ve been using credit lines for a few years now.

Opening multiple accounts right from the get-go will actually have the opposite effect. Quality always precedes quantity. Don’t take out a new loan unless you’re confident that you can use the account to your advantage.

5. New Credit Applications and Inquiries (10%)

Having multiple active credit and loan accounts will only boost your standing if they’ve been active for multiple years now and you weren’t opened consecutively. The bureau generally rejects debtors who apply for multiple loans in a short span of time because:

Multiple Loans Imply Cash Flow Issues

It’s generally assumed that debtors who have to take out multiple consecutive loans within a short time frame are experiencing cash flow issues. Lenders often avoid these types of applicants.

Hard Inquiries Hurt Credit Scores

A soft inquiry is when the debtor checks their credit score for reference purposes, or a banking institution pulls a debtor’s credit report for an offer. This type of inquiry does not affect one’s credit score.

Meanwhile, a hard inquiry is when a lender or institution pulls a loan applicant’s credit report for approval. Multiple hard inquiries can tank your credit score. In worse cases, the bureau might bar you from applying to most commercial banking institutions for new credit lines and accounts.

Final Thoughts

Overall, it’s crucial for every debtor to understand the dynamics behind credit scores. Make sure you’re at least familiar with the factors that drive these scores up and down, which institutions are strict with credit scores, and how to quickly, efficiently boost your credit standing.

Try to avoid getting a credit card if you aren’t yet informed what credit bureaus take into consideration when assigning credit scores. Otherwise, you’ll end up making poorly judged, misinformed decisions. Trust us, even the smallest purchases, credit card applications, and missed payments can greatly affect one’s credit scores.

Comments

Post a Comment